Dear Readers,

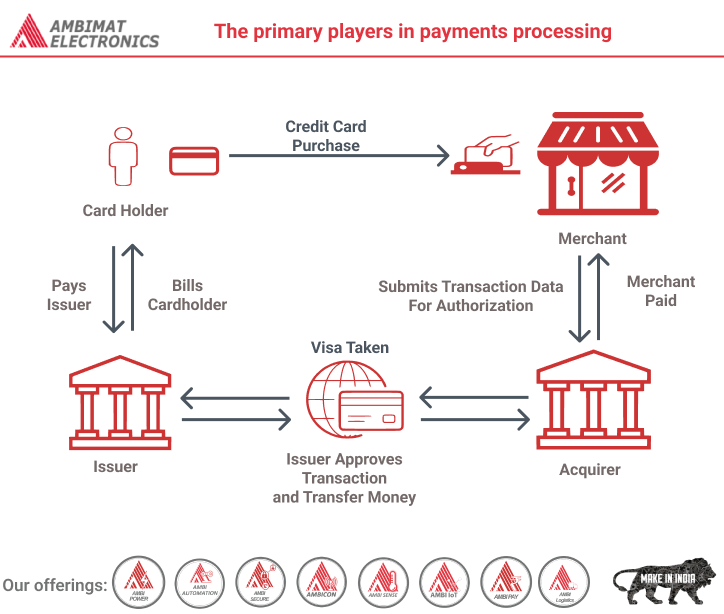

In this blog we are going to learn about, Navigating the intricate world of payment processing involves understanding a web of players, each with unique roles and revenue-generating mechanisms. At the center are card networks like Visa, MasterCard, American Express, and Discover, serving as vital conduits that facilitate transactions across consumers, merchants, processors, and banks. They earn revenue by collecting a small percentage of the total transaction volume. Card issuers, typically banks, furnish consumers with payment cards tied to these networks and earn interchange fees from merchant acquirers for every transaction. Merchant acquirers, including payment processors and Independent Sales Organizations (ISOs), assist merchants in accepting and processing payments, their earnings driven by transaction volume and value-added services. ISOs, serving as intermediaries, resell processor services and profit from the merchant discount after other stakeholders have taken their share. Each entity within this intricate ecosystem contributes uniquely to the payment landscape while generating revenue through distinct mechanisms and functions.

The world of payment processing can be a confusing place to map out—a fact exacerbated by naming conventions. There are card companies, which don’t (generally) issue the cards, that process and facilitate transactions among all the other players. There are processors, which provide services to merchants and might move money between banks. There are banks that work with merchants, and banks that work with consumers by issuing credit cards and credit.

And then there are certain players that do a bit of everything. Over the last decade, many large players have moved full-stack.

In fact, an average credit card transaction involves some half a dozen players as it goes from consumer to merchant to gateway to processor to network to issuing bank and merchant bank, and back again.

Card networks

Card networks Visa, MasterCard, American Express, and Discover sit at the center of the payment industry, facilitating transactions among consumers, merchants, processors, and banks. These companies supply the electronic networks that allow all the players to communicate and process transactions. For their trouble, they charge fees to the financial institutions involved in transactions based on total transaction volume (rather than on a per-transaction basis). That’s why some people liken their function to the payments industry’s tollbooth.

How card networks make money

Card networks—for simplicity in this explanation, let’s say Visa—receive fees from the issuing and acquiring financial institutions. Visa makes money by collecting a small percentage (0.13 percent as of early 2015) of total transaction volume, rather than by charging a fee on each transaction. But it also sets and doles out the rest of the fee paid by the merchant to the other players. While this percentage may seem nominal, billions of transactions processed each year (with minimal overhead) add up to a very profitable industry.

What’s more, a network like Visa’s entrenched partnerships and critical technologies create high barriers to entry for new players. Established card networks also have low marginal costs to continue operating, making them attractive business models.

The business models of American Express and Discover differ from Visa and MasterCard: They consolidate the functions of the merchant bank, card issuer, and card network by personally extending credit and cards, so that fewer parties are involved in their transactions.

Card Issuers

Card issuers are financial institutions that provide card network payment cards to consumers. So, for example, Capital One might issue a Visa card. These institutions also issue payment to the merchant bank (also called the acquiring bank) on behalf of its customers, the buyers in any given transaction.

How card issuers make money

On each transaction, the card issuer—let’s say Capital One—receives an interchange fee from the merchant acquirer, like Chase Paymentech, Wells Fargo, or First Data, which work directly with the merchant. The interchange fee is set by the card network, and the amount tends to be highly variable, based on a combination of factors such as card type, transaction type, merchant type, and level of risk for the given transaction.

Merchant Acquirers

In order for merchants to accept payments, they have to work with financial institutions. In the payments world, these institutions are referred to as merchant acquirers. These come in a few different forms: Either payment processors or Independent Sales Organizations.

Processors

Processors are technological systems that work with banks and card networks to help merchants accept and process credit, debit, and prepaid payments. They verify transaction details, ensure funds are available, and perform certain anti-fraud measures. Processors may be associated with banks, like Chase or Bank of America, or they can be independent, like First Data and Vantiv (which spun out of American Express and Fifth Third Bank, respectively). They’re distinguished by their technical ability to carry out transactions.

To add to the complications, processors sometimes use ISOs to sell their services, despite their competitive nature.

How processors make money

Processors make most of their money from:

- Accepting and processing payments

- Settlement of funds

Certain processors, like Vantiv, also work with financial institutions to integrate other services.

For merchant services, revenue is driven by the number of transactions and the dollar amount of sales volume. Fees may be based on the merchant discount rate, which is a percentage of the sale amount, or be a fixed fee per transaction. Financial institution service fees are either fixed per transaction or volume-driven based on value-added services, according to Vantiv data.

ISO’s

Independent Sales Organizations (ISOs) act as intermediaries between merchants and their banks, essentially reselling the services of processors. In some cases, they might actually be banks: For example, Wells Fargo is a First Data ISO.

As payment gateways, they ensure the secure transfer of the transaction data. They also service merchant bank accounts and might create the relationship between a merchant and bank in the first place. For example, Square offers its merchants a merchant acquirer relationship with Chase Paymentech. ISOs also lease point-of-sale terminals to merchants and may service customers who have problems with their cards. Because an ISO is not a bank, it does not physically manage merchants’ money and is also not regulated in the same way. This is part of the reason why much of the innovation in the payments space has been around ISOs.

Traditional ISOs, which provide point-of-sale technology to offline merchants, include Verifone and NCR. But there are plenty of newer entrants, like Braintree, Stripe, and Square.

How ISO’s make money

ISOs make money in a number of ways—similar to the number of functions they perform. Their fees also vary, depending on the contracts they have. ISOs are paid the remainder of the merchant discount after the card issuer, network, and merchant acquirers get theirs. So, for example, Square would get a cut after Capital One, Visa, and Chase Paymentech all get paid after a transaction. On certain transactions, ISOs actually lose money. These losses tend to be offset, though, when they’re able to charge the same fee for purchases made with debit cards (which have very low interchange fees) or when they make money on other services.

About Ambimat Electronics:

With design experience of close to 4 decades of excellence, world-class talent, and innovative breakthroughs, Ambimat Electronics is a single-stop solution enabler to Leading PSUs, private sector companies, and start-ups to deliver design capabilities and develop manufacturing capabilities in various industries and markets. AmbiIoT design services have helped develop Smartwatches, Smart homes, Medicals, Robotics, Retail, Pubs and brewery, Security.

Ambimat Electronics has come a long way to become one of India’s leading IoT(Internet of things) product designers and manufacturers today. We present below some of our solutions that can be implemented and parameterized according to specific business needs. AmbiPay, AmbiPower, AmbiCon, AmbiSecure, AmbiSense, AmbiAutomation.

To know more about us or what Ambimat does, we invite you to follow us on LinkedIn or visit our website.

References:-

https://fin.plaid.com/articles/major-players-in-payment-processing/