Dear Readers,

In this blog we are going to learn about, Transitioning from magnetic stripe to EMV chip payments may seem like a straightforward card technology switch, but it represents a profound shift in the payments landscape, impacting acceptance, processing, and product design. For merchants, implementing EMV chip technology is a complex endeavor that demands early action, preparation, and understanding. In the United States, the migration to EMV chip technology began over three years ago, driven by the goal of reducing counterfeit card fraud and promoting global interoperability. To facilitate this transition, payment brands introduced fraud liability shift dates, with the first one occurring on October 1, 2015. After these dates, the responsibility for fraud in a payment transaction shifts to the party using the least secure technology. For hospitality merchants, failing to upgrade payment systems to accept chip cards can result in additional fraud losses. Upgrading to chip technology not only offers fraud protection but also provides an opportunity to foster customer loyalty as consumers increasingly value the security benefits of chip cards. Despite these advantages, many hospitality merchants are still in the early stages of learning about the EMV standard and initiating implementation projects. This article, in collaboration with FIME America, offers a 10-step guide for hospitality merchants to efficiently implement an EMV chip solution in the current payment acceptance environment, covering aspects like selecting a migration partner, creating a project roadmap, understanding certification requirements, and more.

On the surface, migrating from magnetic stripe to chip payments seems like a simple card technology change. In practice, moving to chip is a paradigm shift of the payments ecosystem that impacts the way payments are accepted and processed, and the way payment acceptance products are designed. There are many complexities and challenges to introducing EMV chip technology for merchants, and it’s important to start implementation now.

As background, the U.S. is now more than three years into its migration to EMV chip technology with a goal of reducing counterfeit card fraud and promoting global interoperability. To drive the migration, the U.S. payment brands have laid out roadmaps that include fraud liability shift dates, the first of which will take place on Oct. 1, 2015.

After these dates, responsibility for any fraud resulting from a payment transaction will shift to the party using the least secure technology. For the hospitality merchant community, this can mean taking on additional fraud losses if they do not upgrade their payment systems to accept chip cards.

Upgrading to chip technology will also protect hotel, tourism, food service and other merchants in the hospitality industry from becoming a target for fraud. Since hackers and thieves look for the path of least resistance (in this case, magnetic stripe environments), merchants that are not prepared to accept chip cards leave the door open to credit card fraud.

Chip implementation also provides an opportunity for merchants to build customer loyalty. As chip card issuance ramps up, and as consumers become more aware of the security benefits of chip cards, many will prefer to interact with merchants that have shown initiative in securing payments through chip card acceptance.

Even with the fraud protection, customer loyalty benefits and the liability shift dates in place, there are many merchants in the hospitality industry that are only starting to learn about the EMV standard and beginning implementation project plans.

In the EMV arena, chips have it over stripes, and FIME America is offering steps to help hospitality merchants migrate over. These steps, as well as portions of the information included here, have been summarized and excerpted from the FIME white paper, “EMV Chip Migration for U.S. Merchant Community: Implementing Chip in the Complex U.S. Acceptance Environment.”

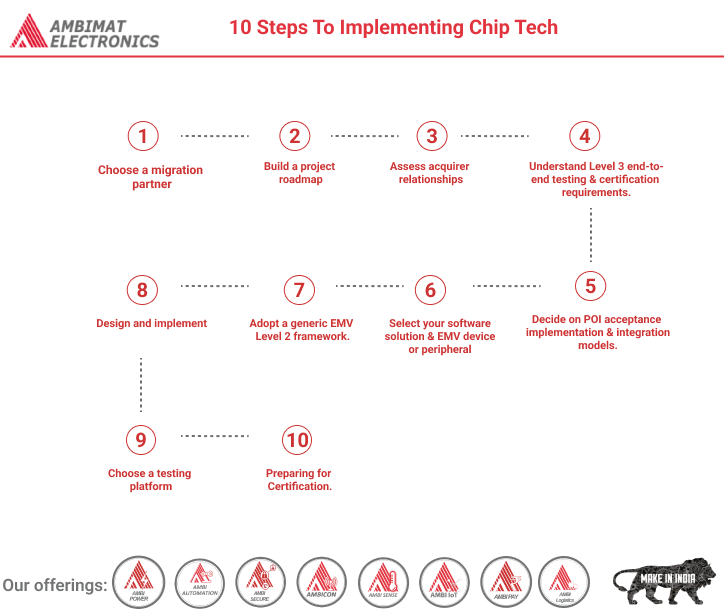

These are the 10 steps hospitality merchants need to implement an EMV chip solution in the most timely and effective way possible in the current payment acceptance environment:

- Choose a migration partner. Selecting a qualified consultancy can help reduce complexities, time and resources associated with all phases of your chip implementation.

- Build a project roadmap. Defining and continually reviewing the roadmap will facilitate and move your project forward.

- Assess acquirer relationships. The processor or acquirer should be identified and selected very early in your EMV chip implementation project.

- Understand Level 3 end-to-end testing and certification requirements. The EMV Migration Forum released a white paper, “EMV Testing and Certification White Paper: Current U.S. Payment Brand Requirements for the Acquiring Community,” that provides a complete overview of the Level 3 brand testing and certification requirements.

- Decide on point-of-interaction (POI) acceptance implementation and integration models. The semi-integrated POI system is the best fit for the hospitality merchant, as chip will introduce less complexity than it would in a fully integrated system.

- Select your software solution and EMV device or peripheral. Consider using device-independent, off-the-shelf payment acceptance solutions instead of building your own to greatly reduce time and resources spent on design, implementation and testing and certification.

- Adopt a generic EMV Level 2 framework. Universal EMV application frameworks for EMV devices (i.e. terminal and PIN pads) offer another way to accelerate U.S. EMV implementation projects and reduce the qualification and certification workload.

- Design and implement. New solutions should take into account the retailers’ global operational requirements at the same time as providing solutions that can adapt to existing POS system architectures.

- Choose a testing platform. When weighing options, consider using an advanced test platform to automate the test tasks and reduce the most time-consuming aspects of the project.

- Preparing for Certification. It is a best practice to test your implementation using the payment brand test plans supported by the approved test tools discussed earlier to minimize test issues during the terminal end-to-end certification process conducted with the acquirer.

Through leveraging these best practices and through industry collaboration, merchants in the hospitality industry can reduce complexities and deploy fully certified chip acceptance solutions to the market in the most timely and effiicient manner possible.

About Ambimat Electronics:

With design experience of close to 4 decades of excellence, world-class talent, and innovative breakthroughs, Ambimat Electronics is a single-stop solution enabler to Leading PSUs, private sector companies, and start-ups to deliver design capabilities and develop manufacturing capabilities in various industries and markets. AmbiIoT design services have helped develop Smartwatches, Smart homes, Medicals, Robotics, Retail, Pubs and brewery, Security.

Ambimat Electronics has come a long way to become one of India’s leading IoT(Internet of things) product designers and manufacturers today. We present below some of our solutions that can be implemented and parameterized according to specific business needs. AmbiPay, AmbiPower, AmbiCon, AmbiSecure, AmbiSense, AmbiAutomation.

To know more about us or what Ambimat does, we invite you to follow us on LinkedIn or visit our website.

References:-

https://hospitalitytech.com/think-youre-ready-emv-10-steps-implementing-chip-tech