Dear Readers,

In this blog we are going to learn about, A virtual terminal is a versatile web-based software application designed to streamline credit card processing for businesses, allowing them to accept card payments even when customers cannot physically present their cards for payment. Originally embraced by mail-order and telephone-order businesses, modern virtual terminals have evolved to offer a wide array of features, making them a cost-effective alternative to conventional credit card terminals and point-of-sale (POS) systems, especially for card-present transactions. In this article, we’ll delve into the concept of virtual terminals, explore the key features to consider when selecting the right one for your business, and highlight six top virtual terminal providers tailored for small businesses, all while emphasizing the critical role of payment processing for small enterprises.

What are virtual terminals, and how do they benefit your small business? Virtual terminal credit card processing is essential if you need to accept credit or debit card payments when a customer isn’t physically available to swipe, dip, or tap their card.

Long favored by mail-order and telephone-order businesses, modern virtual terminals have evolved to include many additional features. They can even be a cost-effective alternative to expensive credit card terminals and point of sale (POS) systems for card-present transactions.

In this article, we’ll explain what a virtual terminal is and describe the most important features you should look for in selecting the best one for your business. We’ll also profile six of the best virtual terminal providers we’ve found for small businesses. And don’t forget that you’ll also need payment processing for your small business.

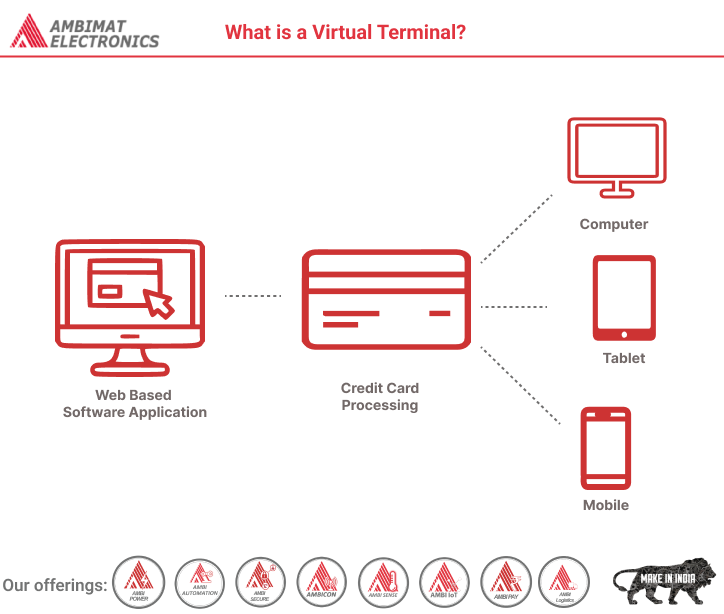

What is a Virtual Terminal?

A virtual terminal is a web-based software application that enables credit card processing on a computer, tablet, or phone. Transactions can be manually keyed in if the physical card is not present. You can also swipe, dip, or tap cards using a compatible credit card reader and a virtual terminal.

What kinds of Businesses Need Virtual Terminal Payment Processing?

In general, any business where a traditional countertop terminal or point of sale (POS) system is either impractical or too expensive will find it advantageous to use a virtual terminal. Here are some examples:

- Food Delivery Services: Customers can prepay over the phone before food delivery.

- Remote Freelance Work: Web designers, graphic artists, writers, and other freelance or consulting businesses that work remotely can settle billing over the phone.

- Local Professionals (e.g., Doctors, Attorneys, Accountants): Take payment over the phone to book clients, settle a running tab, or process from across the counter.

- Auto Mechanics: Your customers can pay you over the phone and pick their car up after hours, and you can collect what’s due during regular business hours, too.

- Other Delivery Services: Whether you own a local pharmacy, deliver wine and spirits, or something else, taking phone orders is an excellent option for smaller delivery-based businesses.

If none of these apply to you, some situations may still arise where a virtual terminal will come in handy. Some merchants enjoy the fact that a virtual terminal enables them to forgo hardware to compensate for limited counter space. While mobile payment processing apps are also an option, some folks live and die by their laptops, so a virtual terminal makes the most sense for their business needs.

Also, merchants who typically process via swiping, dipping, or tapping may need to take payment over the phone once in a while. If you already have a credit card processor, chances are there is a virtual terminal somewhere on the dashboard with which you can manually enter credit card details through a web-based form.

About Ambimat Electronics:

With design experience of close to 4 decades of excellence, world-class talent, and innovative breakthroughs, Ambimat Electronics is a single-stop solution enabler to Leading PSUs, private sector companies, and start-ups to deliver design capabilities and develop manufacturing capabilities in various industries and markets. AmbiIoT design services have helped develop Smartwatches, Smart homes, Medicals, Robotics, Retail, Pubs and brewery, Security.

Ambimat Electronics has come a long way to become one of India’s leading IoT(Internet of things) product designers and manufacturers today. We present below some of our solutions that can be implemented and parameterized according to specific business needs. AmbiPay, AmbiPower, AmbiCon, AmbiSecure, AmbiSense, AmbiAutomation.

To know more about us or what Ambimat does, we invite you to follow us on LinkedIn or visit our website.