Dear Readers,

What Does CVV Stand For?

CVV stands for card verification value. It’s a three- or four-digit number found on most debit and credit cards.

There are several other acronyms for this security feature within the industry.

The Purpose of CVVs

Since chip-enabled card technology has managed to sharply cut back on physical card fraud, criminals have shifted their focus to the digital realm. Creating fake cards has given way to online information theft. Enter the CVV, which banks and credit card issuers use to reduce fraudulent digital transactions.

There are two CVVs associated with most debit or credit cards. The first is encoded in the magnetic strip used for in-person transactions; the second is visible on the card. This is the one you must input when making an online purchase.

While it can be comparatively easy for skilled hackers to gain access to credit card numbers and expiration dates, CVVs are much more difficult to track down. This is largely due to industry regulations. According to PCI (Payment Card Industry) standards, merchants may store your credit card number and expiration date, but they cannot store your CVV. So, while you may not like to enter the number for each online transaction, doing so is what provides that extra layer of security.

Where Do I Find the CVV?

Finding your CVV depends on the type of card you have. For Visa, Mastercard and Discover cards, you’ll find the three-digit code on the back, usually inside or just above the signature strip. American Express does things differently, placing a four-digit CVV on the front, above the Amex logo.

Is There a Difference Between a CVV and a PIN?

A PIN is a user-created “personal identification number.” Most of the time a PIN is four digits, though some banks require longer numbers. Credit cards use PINs for cash advances, while debit cards use them for withdrawing cash or initiating a purchase. Neither of these PINs is the same as a CVV.

CVVs are automatically generated by the credit card issuer and are printed on the card. While a bank may initially provide a PIN when your debit or credit card is issued, it’s only temporary. In most cases you will be required to change it to a number you designate. You have no such control over a CVV.

Does a New Card Have a New CVV?

As a matter of security, generally, no two cards have the same CVV. If you sign up for a new credit card or replace an existing one, you’ll end up with a new code; the same applies if your current card expires and you receive a replacement. Even if your credit card number is exactly the same, you will still have a different CVV.

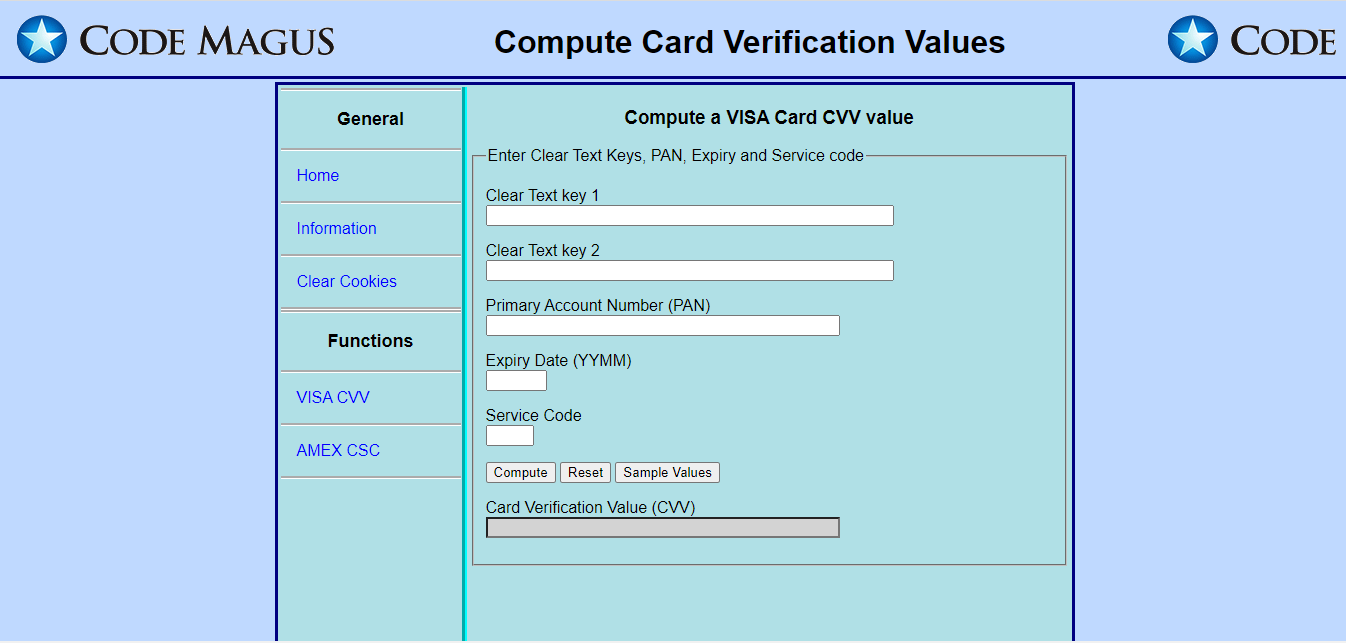

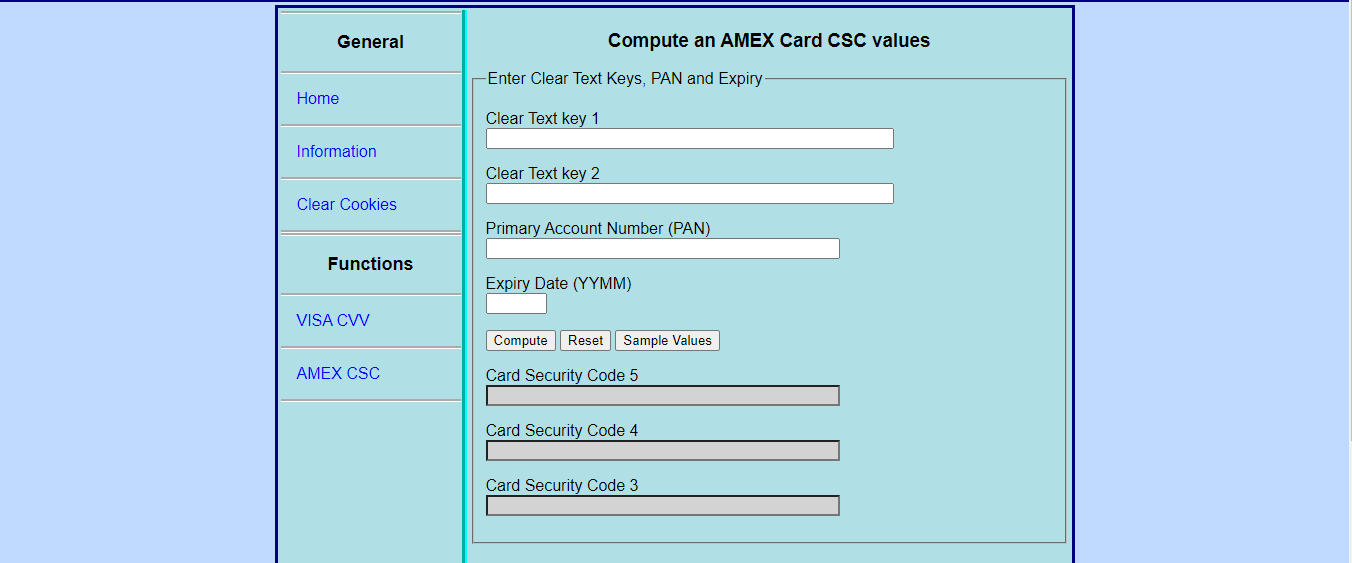

How Are CVVs Generated?

As it turns out, CVVs are not random three- or four-digit numbers. Rather, banks generate them using four pieces of information: primary account number, four-digit expiration date, a pair of DES (Data Encryption Standard) keys and a three-digit service code. For obvious reasons, the precise algorithms used are unknown.

How Can I Protect My CVV?

To avoid becoming a victim of credit card fraud, you should protect your CVV like any other important piece of financial information. Here are seven simple ways to prevent your CVV from falling into the wrong hands.

- Install anti-virus software on your computer. This will scan for viruses, keyboard-logging software and other tools that hackers use to steal personal information.

- Password-protect your home’s WiFi network. If you don’t, anyone within range can connect, monitor your internet traffic and track any information you send.

- Only enter your credit card information on trusted websites. Avoid websites without “https:” in the address; the same goes for those that don’t show the SSL padlock in your browser window.

- Use a VPN when browsing away from home. Although this might be overkill at home, when traveling or using public WiFi you should use VPN software to protect your personal information.

- Don’t share photos of your credit card, either with friends or on social media. Someone could make unauthorized purchases using your card data.

- Ignore unsolicited requests for your personal information. If someone requests your credit card information by phone or email, ask why they need it. If sensitive financial information needs to be transmitted in this way, it’s generally better if you’re the one to initiate the interaction.

- Check your account activity regularly. Review your transactions online or when the statement comes in the mail to ensure that you approved each one. If there’s a charge you don’t recognize, contact your bank immediately. You may need a new card.

Now the Question arises!!, as to how to Compute the CVV. So,

Here are the Image of the Process

About Ambimat Electronics:

With design experience of close to 4 decades of excellence, world-class talent, and innovative breakthroughs, Ambimat Electronics is a single-stop solution enabler to Leading PSUs, private sector companies, and start-ups to deliver design capabilities and develop manufacturing capabilities in various industries and markets. AmbiIoT design services have helped develop Smartwatches, Smart homes, Medicals, Robotics, Retail, Pubs and brewery, Security.

Ambimat Electronics has come a long way to become one of India’s leading IoT(Internet of things) product designers and manufacturers today. We present below some of our solutions that can be implemented and parameterized according to specific business needs. AmbiPay, AmbiPower, AmbiCon, AmbiSecure, AmbiSense, AmbiAutomation.

To know more about us or what Ambimat does, we invite you to follow us on LinkedIn or visit our website.

References:-

https://www.forbes.com/advisor/credit-cards/what-is-a-credit-card-cvv-number/